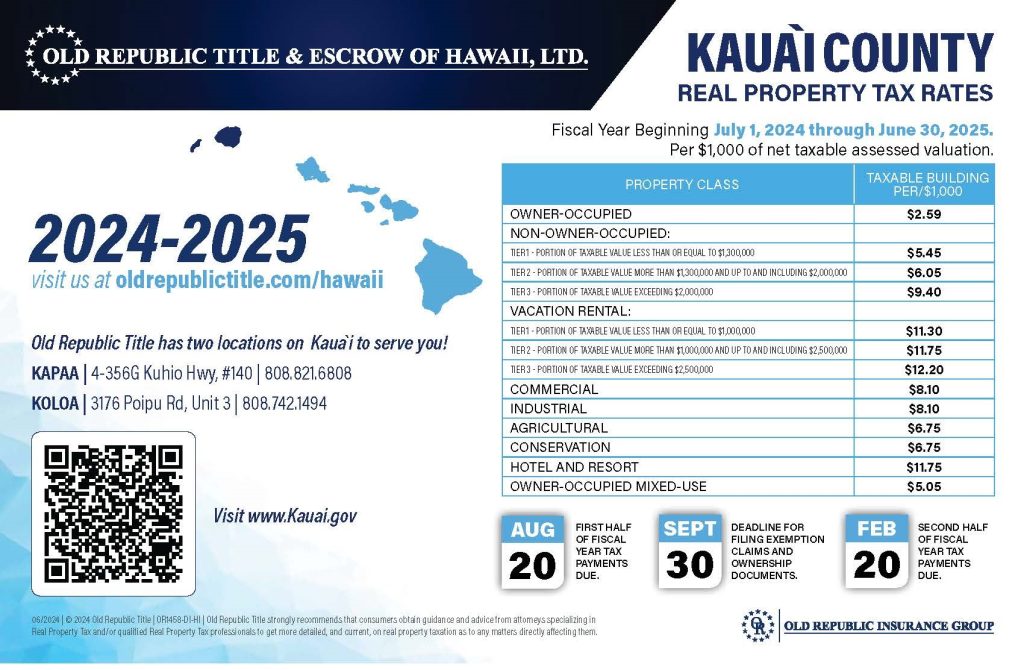

2024 Assessment Year Exemptions/Tax Relief ….filling deadline is September 30, 2023

-

HOME EXEMPTION – Residents must occupy their property as their principal home, have a current Hawaii Driver’s License and file a full-time resident State of Hawaii Income tax return.

-

ADDITIONAL EXEMPTION BASED ON OWNER OCCUPANTS INCOME – Gross income of all owner occupants must not exceed $96,550. 2022 Federal and State of Hawaii tax returns and an approved home exemption are required.

-

LONG-TERM AFFORDABLE RENTAL PROGRAM – Rental Limits are based on 90% of the Kauai median household income. 1 year or longer fixed term lease is required. All units must qualify or be owner occupied with a home exemption.