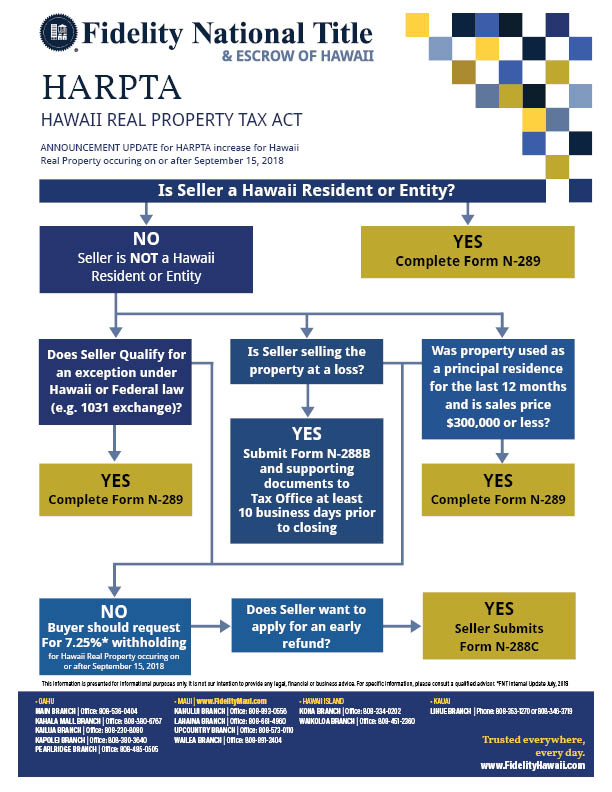

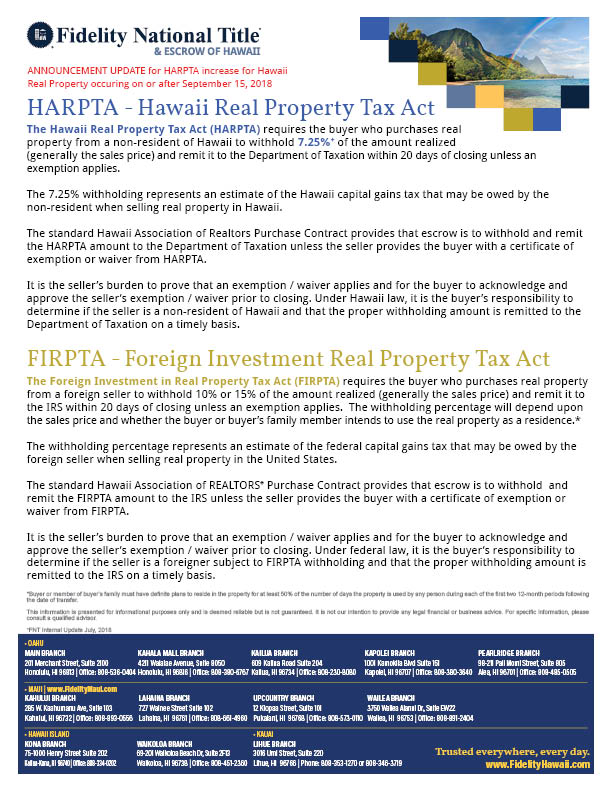

HARPTA stands for Hawaii Real Property Tax Act

HARPTA refers to the withholding of Hawaii Income tax on the disposition of Hawaii real property by non-resident persons. This tax is NOT to be confused with real property tax. HARPTA withholding is a tax on the income generated from the disposition of Hawaii real estate.

Disclaimer: ( This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.)

The following is a link to the State of Hawaii, Dept of Taxation regarding HARPTA (revised 2020)

State of Hawaii- Understanding HARPTA

Here is additional HARPTA information provided by Fidelity National Title.